(ElevatePay) Assalamu Alaikum! If you are a hardworking freelancer, a growing e-commerce seller, or a remote worker in Pakistan, you are likely all too familiar with the frustrations of cross-border payments. High transaction fees, arbitrary percentage cuts, sluggish payout speeds, and money that seems to disappear into hidden charges—these issues can severely limit your earning potential and financial peace of mind.

For years, Pakistani professionals have struggled to find a reliable, cost-effective, and fast payment solution that truly understands the local context while offering a globally compliant service. We have relied on a few established names, often accepting their high costs and slow speed as the unfortunate standard.

However, a new and exciting solution has entered the market. It is specifically designed to address these pain points for the Pakistani digital economy. Today, we are going to dive deep into ElevatePay, a platform that promises to revolutionize how you receive and manage your international earnings.

This comprehensive guide from Zebialerts.com will review everything you need to know about ElevatePay: what it is, how it works, why its fee structure beats the competition, and the significant tax benefits it offers to Pakistani earners. If you are tired of losing your hard-earned money to high charges, this article is essential reading.

read more How to Become Filer in FBR Online Step by Step 2025 Guide

What is ElevatePay and Why Does it Matter to You?

ElevatePay is a VC-backed fintech company that provides Pakistani freelancers and businesses with something invaluable: a genuine US bank account. This is not a virtual wallet or a simple money transfer service; it is a real Automated Clearing House (ACH) enabled, USD bank account issued through Bank Merchants Commercial Bank Link.

Why is this important? Because having a real US bank account changes your status from an international recipient to a domestic US payment receiver. This instantly unlocks major benefits and compliance advantages that were previously inaccessible.

The Foundation of Trust and Security

When dealing with international funds, security and regulation are paramount. ElevatePay offers two crucial layers of financial assurance:

- ACH Enabled: This means the account is fully integrated with the US banking system, allowing for direct and secure transfers.

- FDIC Insured: Your USD account is insured by the Federal Deposit Insurance Corporation (FDIC). This is a crucial mark of trustworthiness, ensuring your funds are secure within the US regulated banking environment. Your account is fully regulated under the US banking environment, giving you complete peace of mind.

Compatibility Across Global Platforms

The moment you get an ElevatePay account, you can integrate it seamlessly with virtually every major international freelancing and e-commerce platform. ElevatePay is fully compatible with:

- Upwork

- Fiverr

- Toptal

- Deel

- Remote job platforms

- Any US-based company that pays via ACH

- Direct clients sending payments from the US

This broad compatibility ensures that wherever your international income originates, you have a compliant and professional receiving method.

Eliminating Fees: How ElevatePay Maximizes Your Earnings

The single biggest pain point for Pakistani freelancers is the high cost of receiving international money. This is where ElevatePay truly stands out and offers a game-changing value proposition.

Zero Inbound Fee for ACH Payments

Forget percentage cuts on your hard-earned income. ElevatePay operates on an incredibly simple and freelancer-friendly model:

- Incoming ACH payments are absolutely free.

- There is zero percentage cut on the amount you receive.

- There are no hidden fees on the money coming into your ElevatePay account.

When a US client or marketplace (like Upwork or Deel) sends you $1,000, you will see $1,000 land in your ElevatePay account. This alone offers a massive saving compared to traditional platforms that charge anywhere from 1% to 3% just to receive the money.

Transparent and Low Payout Fee to Pakistan

Once the funds are in your ElevatePay USD account, the next step is bringing them home. Again, ElevatePay keeps the costs minimal and completely transparent.

| Transfer Type | Fee Structure | Details |

| Incoming ACH | $0 Flat Fee | Absolutely free to receive funds from US sources. |

| Outbound Transfer to Pakistan | $1.50 Flat Fee | A single, low flat fee regardless of the amount sent. |

Imagine you need to transfer $2,000 to your Pakistani bank account. With ElevatePay, you pay a flat $1.50. This fee structure is a stark contrast to services that implement tiered pricing or non-transparent FX markups, ensuring you have complete control over your money.

Expert Insight: The flat $1.50 fee eliminates the “FX Markup Game.” Many providers hide fees in poor exchange rates. ElevatePay provides some of the best market FX rates, giving you the maximum possible PKR conversion for your USD.

Speed and Convenience: Instant Settlement in Pakistan

Another major advantage of ElevatePay is the speed of its transfers to Pakistan. Unlike platforms that might take several business days for processing and settlement, ElevatePay offers an instant payout facility.

Fast Inbound, Instant Outbound

- US Transfer Time: Incoming ACH payments usually arrive in your ElevatePay US account within one business day.

- Pakistan Payout: Sending money from your ElevatePay account to Pakistan is instantaneous.

You can transfer funds within seconds to all major local payment methods, including:

- JazzCash

- Easypaisa

- NayaPay accounts

- Any local Pakistani bank account

This means you can transfer funds from the US, and within a few seconds, you will see the money credited to your local account. For freelancers and businesses who rely on immediate access to cash flow, this is a critical feature that can sustain operational momentum.

Maximizing Benefits: PRC Certificate and Tax Savings

For established freelancers and e-commerce sellers in Pakistan, managing tax compliance and benefits is as important as earning the money itself. ElevatePay assists you in maximizing your financial benefits through a crucial feature: the PRC Certificate.

What is a PRC Certificate?

PRC stands for Proceeds Realization Certificate. This document confirms that the foreign currency you received came from an export remittance (an international source). ElevatePay provides you with a PRC Certificate for every single withdrawal you make to Pakistan.

The certificate is issued with relevant purpose codes, such as 9186 and 9471, which legally categorize your income as Export Remittance.

The Tax Advantage: PSEB Rate Eligibility

Receiving a PRC Certificate is the key to unlocking significant tax savings in Pakistan:

- Export Income Treatment: When you have a PRC, your income is legally treated as export remittance.

- Lower Tax Rate: This makes you eligible for the special, reduced PSEB (Pakistan Software Export Board) tax rate, which is currently 0.25% of your income.

- Avoiding Local Income Status: Without a PRC, your international income is often treated as regular local income, subjecting you to significantly higher tax rates.

In short, ElevatePay helps you receive more money due to lower fees and helps you keep more money due to the crucial tax benefit provided by the PRC Certificate.

Home Remittance Rewards

As your base country is Pakistan, ElevatePay also offers a unique incentive when you use their Home Remittance option for transfers:

- You receive a $2 reward per eligible transaction.

- This is in addition to the $1.50 fee saving you get from the low flat fee.

Essentially, you are not just saving money; you are earning money on eligible transfers, which turns the traditional cost-center of international transfer into a potential profit point.

How to Onboard with ElevatePay: A Simple Procedure

Setting up your ElevatePay account is a straightforward process, though it requires necessary documentation to comply with US banking and KYC (Know Your Customer) regulations.

go to https://www.elevatepay.co/

The Application Timeline

- Your account typically gets approved within 7 to 10 days after you submit all necessary documentation.

Required Documentation

To verify your identity and the source of your international income, you will need to provide the following basic information:

| Requirement Category | Specific Documents Needed | Purpose |

| Identity & Address | CNIC or Passport, Proof of Address (utility bill, etc.) | Standard KYC and physical verification. |

| Source of Funds (SOF) | Upwork/Fiverr Statements, Client Contracts, Invoices | To verify the legitimacy of your export income. |

This is standard procedure for any globally compliant financial service. Once approved, you will officially be the owner of your very own US bank account.

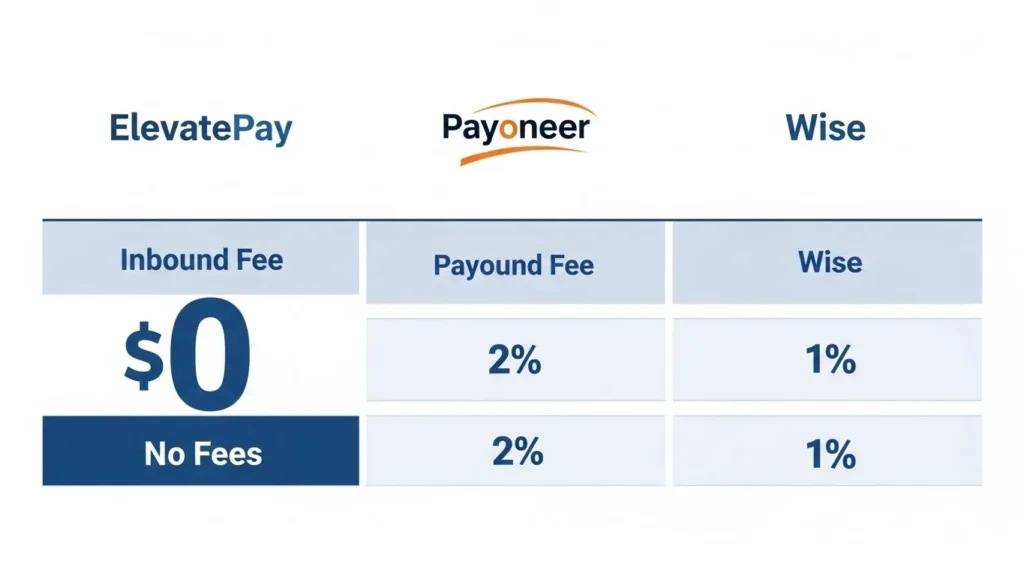

ElevatePay vs. The Competition (Payoneer & Wise)

Many Pakistanis already use services like Payoneer or Wise. So, why make the switch to ElevatePay? The key difference lies in the fee structure and local benefits.

| Feature | ElevatePay | Payoneer (Typical) | Wise (Typical) |

| Inbound ACH Fee | $0 (Absolutely Free) | Percentage cut (often 1-3%) | Variable fee structure |

| Payout to Pakistan Fee | $1.50 Flat Fee | Variable, often higher fees | Variable, often percentage-based fees |

| Payout Speed to PK | Instant Settlement | 1–3 business days | Variable, often 1–3 days |

| FX Rates | Best Market Rates | Less favorable FX rates | Good, but fees apply |

| PRC Tax Benefits | Yes (PRC provided) | Generally no/difficult | Generally no/difficult |

| Local Support | Yes (Team in Pakistan) | Global/International Support | Global/International Support |

The simple math makes a compelling case: $0 inbound fee combined with a $1.50 flat outbound fee drastically reduces your costs, and the added PRC tax benefit makes ElevatePay the clear winner for maximizing earnings in the Pakistani market.

Final Thoughts and Next Steps

The introduction of ElevatePay is a truly fantastic initiative for Pakistan’s digital economy. It directly solves the most pressing financial issues faced by our freelancers and e-commerce sellers—high costs, slow transfers, and tax uncertainty.

By offering a secure, US-regulated banking environment with a flat, transparent fee structure and essential local benefits like the PRC Certificate and instant settlement, ElevatePay is not just a payment solution; it’s a growth partner.

If you are serious about reducing your operating costs, accessing your money instantly, and securing substantial tax savings, the time to act is now.

Take Action: If you are ready to stop paying excessive fees and switch to a service that prioritizes your success, you can begin the onboarding process immediately. Click the provided link, follow the simple instructions, and start your application today.

Stop giving away your percentage; start earning, receiving, and taking instant transfers with confidence inside Pakistan. This is the solution the market has been waiting for.