In the modern gig economy, your ability to work is your only real currency. For the millions of self-employed individuals across Britain, finding Affordable Health Insurance for Freelancers in the UK has shifted from a luxury to a critical business survival tactic. If you are a freelancer, you don’t have a HR department to provide a “safety net.” If you fall ill, the revenue stops, but the bills don’t. This guide explores how to secure Affordable Health Insurance for Freelancers in the UK without draining your business bank account.

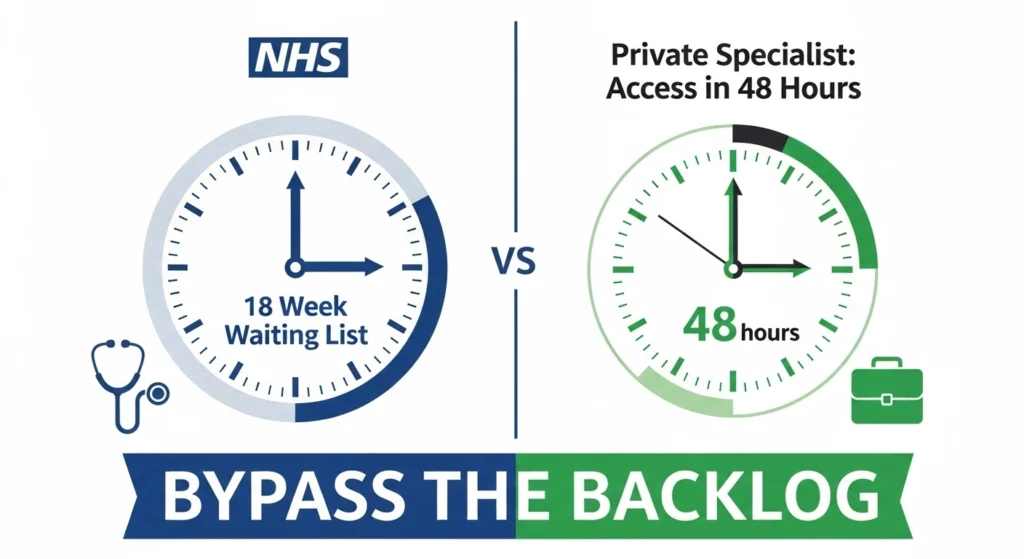

The reality of 2026 is that the NHS is facing unprecedented pressure. With elective care waiting lists often exceeding 18 weeks, a freelancer cannot afford to wait months for a minor surgery or diagnostic test. This is exactly where Affordable Health Insurance for Freelancers in the UK provides its greatest value. By bypassing the public backlog, you ensure that you are treated quickly and back to earning as soon as possible. Securing Affordable Health Insurance for Freelancers in the UK is, quite literally, protecting your income.

Why Self-Employed Health Coverage UK is the Best Business Move

When you transition from a corporate role to self-employment, you lose more than just a salary; you lose benefits. Searching for self-employed health coverage UK is the first step to restoring that security. Most freelancers believe that private care is only for the wealthy, but the market for Affordable Health Insurance for Freelancers in the UK has changed. With the rise of modular plans, you can now find low-cost PMI for freelancers that specifically targets the conditions that would keep you away from your desk.

ALSO read ElevatePay Review: The New US Bank Account Solution for Pakistani Freelancers

Many professionals are now looking for private healthcare for digital nomads UK because their work takes them across borders. Whether you are working from a flat in Manchester or a beach in Bali, having Affordable Health Insurance for Freelancers in the UK that includes international modules is a game-changer. It ensures that your self-employed health coverage UK remains valid wherever your laptop is open.

Understanding the Cost of Cheap Private Medical Insurance UK

You might be asking, “How much does Affordable Health Insurance for Freelancers in UK actually cost?” For a healthy freelancer in their 30s, cheap private medical insurance UK can start for as little as £25 to £45 per month. This is comparable to a few coffee runs or a monthly software subscription. To keep your plan as Affordable Health Insurance for Freelancers in UK, you need to understand how premiums are calculated.

| Factor | Impact on Cost | How to Save |

| Age | High | Start Affordable Health Insurance for Freelancers in UK early. |

| Excess | Very High | Increase your excess to lower Affordable Health Insurance for Freelancers in UK costs. |

| Hospital List | Moderate | Use regional lists to maintain Affordable Health Insurance for Freelancers in the UK. |

| Underwriting | High | Choose Moratorium for faster Affordable Health Insurance for Freelancers in UK setup. |

By tweaking these variables, you can ensure that you always have Affordable Health Insurance for Freelancers in the UK that fits your current budget.

Top Strategies to Keep Your Insurance Low-Cost

To maintain Affordable Health Insurance for Freelancers in the UK over the long term, you have to be strategic. You don’t need a “Platinum” plan; you need a plan that works when it counts.

1. The Power of the 6-Week Rule

This is the “secret weapon” for anyone seeking Affordable Health Insurance for Freelancers in UK. If the NHS can treat you within 6 weeks, you use the NHS. If the wait is longer, your cheap private medical insurance UK pays for private treatment immediately. This can save you up to 30% on your premiums while still providing the speed you need.

2. Choosing Low-Cost PMI for Freelancers

Many insurers now offer low-cost PMI for freelancers which focuses purely on “In-patient” care. This means major surgeries and hospital stays are covered, but you pay for minor things like GP visits yourself. This is a great way to keep Affordable Health Insurance for Freelancers in UK sustainable for your business.

3. Wellness Incentives and Active Rewards

Providers like Vitality have revolutionized Affordable Health Insurance for Freelancers in the UK by rewarding healthy habits. If you walk 10,000 steps a day, your premiums can actually drop. This makes your Affordable Health Insurance for Freelancers in UK not just a cost, but a motivation to stay healthy.

Integrating Freelancer Income Protection UK

While Affordable Health Insurance for Freelancers in the UK pays the surgeon, it doesn’t pay your mortgage. This is why freelancer income protection UK is a vital partner to your health policy. If you are diagnosed with a condition that keeps you out of work for six months, freelancer income protection UK pays you a monthly tax-free salary.

Many providers offer a discount when you bundle Affordable Health Insurance for Freelancers in UK with freelancer income protection UK. This “Total Coverage” approach is the only way to truly protect yourself from the financial risks of being self-employed. In 2026, having both Affordable Health Insurance for Freelancers in UK and income protection is considered the gold standard of financial planning.

Tax Benefits: Limited Company vs. Sole Trader

One major factor in keeping Affordable Health Insurance for Freelancers in UK truly “affordable” is how you pay for it.

- Sole Traders: HMRC views Affordable Health Insurance for Freelancers in UK as a personal expense. You cannot deduct the premium from your taxable profits.

- Limited Company Directors: Your company can pay for your Affordable Health Insurance for Freelancers in UK. It is a deductible expense for the company (saving Corporation Tax), but it is a “Benefit in Kind” for you. Even with the BIK tax, it often works out cheaper than paying for Affordable Health Insurance for Freelancers in UK from your post-tax personal income.

Private Healthcare for Digital Nomads UK: Working Remotely

The workforce is more mobile than ever. If you are a remote worker, you need private healthcare for digital nomads UK. Standard Affordable Health Insurance for Freelancers in the UK might only cover you within the 4 nations. By adding a “Worldwide” or “Europe-wide” module, you transform your Affordable Health Insurance for Freelancers in UK into a global safety net.

This is particularly important for tech freelancers who spend winters in warmer climates. Having private healthcare for digital nomads UK means you don’t have to rely on local travel insurance, which often has low limits and poor service. Instead, your Affordable Health Insurance for Freelancers in UK provider manages your care through their international network.

How to Compare and Secure Your Policy in 2026

Getting Affordable Health Insurance for Freelancers in the UK is a simple 4-step process:

- Audit Your Needs: Do you just want to skip queues for surgery, or do you need dental and optical too? Focus on what makes Affordable Health Insurance for Freelancers in the UK work for your lifestyle.

- Compare Providers: Use specialized brokers who understand low-cost PMI for freelancers.

- Review the Excess: A £500 excess can slash your Affordable Health Insurance for Freelancers in UK premium by a huge margin.

- Declare Everything: When applying for Affordable Health Insurance for Freelancers in UK, honesty is the best policy. Hidden conditions can lead to rejected claims.

The Future of Healthcare for the UK Self-Employed

As we move through 2026, the gap between public and private care continues to widen. Affordable Health Insurance for Freelancers in the UK is no longer a luxury—it is a tool for professional resilience. By choosing self-employed health coverage UK that is modular and flexible, you can ensure that your health never becomes a bottleneck for your business growth.

Whether you choose cheap private medical insurance UK for basic cover or a comprehensive plan with freelancer income protection UK, the most important thing is to start today. Every year you wait, the cost of Affordable Health Insurance for Freelancers in UK increases slightly. Secure your Affordable Health Insurance for Freelancers in UK now and focus on what you do best: growing your business.

People Also Ask (FAQs)

1. Is health insurance a tax-deductible business expense?

For sole traders, no. For Limited Companies, it is deductible but carries a Benefit in Kind tax. However, it still makes Affordable Health Insurance for Freelancers in UK more cost-effective.

2. Can I get Affordable Health Insurance for Freelancers in UK if I am over 50?

Yes, but the cost will be higher. Increasing your excess is the best way to keep Affordable Health Insurance for Freelancers in UK within budget as you age.

3. What is the difference between PMI and Income Protection?

PMI (like Affordable Health Insurance for Freelancers in uK) pays for your treatment. Income protection pays your salary while you recover.

4. How does the 6-week rule affect my coverage?

It makes your Affordable Health Insurance for Freelancers in UK cheaper by utilizing the NHS for short-term waits and private care for long-term backlogs.

5. Which is the best provider for low-cost PMI for freelancers?

WPA, AXA, and Vitality are currently the leaders in offering Affordable Health Insurance for Freelancers in UK for the year 2026.

visit https://commonslibrary.parliament.uk/research-briefings/cbp-7281/